What Is The Best Insurance Coverage?

The best insurance coverage provides insurance protection and has you prepared for life’s “what ifs” before a loss.

This means that the best insurance coverage is personal – tailored to you. It also means you should discuss your protection needs with an insurance broker before you buy to make sure you are getting the best insurance coverage for your insurance needs.

In fact, the most expensive insurance you’ll ever buy may well be the policy with the lowest price. By this we mean that the lowest priced policies may not include the insurance coverage you may need in the event of a claim. If you don’t have the right insurance and you have a claim that is not covered or your losses exceed your coverage, you will have to pay for the losses yourself and this can be very expensive.

Marci, An Insurance Broker At Morison, Explains The Value Of Having The Best Insurance Coverage:

“As conscientious consumers it doesn’t sit well with us when we pay more for a product than we feel we should. The price of the products we purchase is very important to us. It is easy to qualify what we are getting for our money’s worth with tangible products. If different companies are offering the exact same product with the exact same features, it is natural for us to purchase it from the company with the lowest price.

However, when it comes to insurance, we should not test our purchase the same way. The test of the quality of insurance comes when you have a claim. This is when coverage becomes far more important than price. Experiencing a claim is when you feel and learn the value of having paid more for the proper coverage. It’s better to have peace of mind that professional insurance brokers are here for you to sort things out rather than to have regret for the coverage you did not purchase, and disappointment in not understanding what you bought.

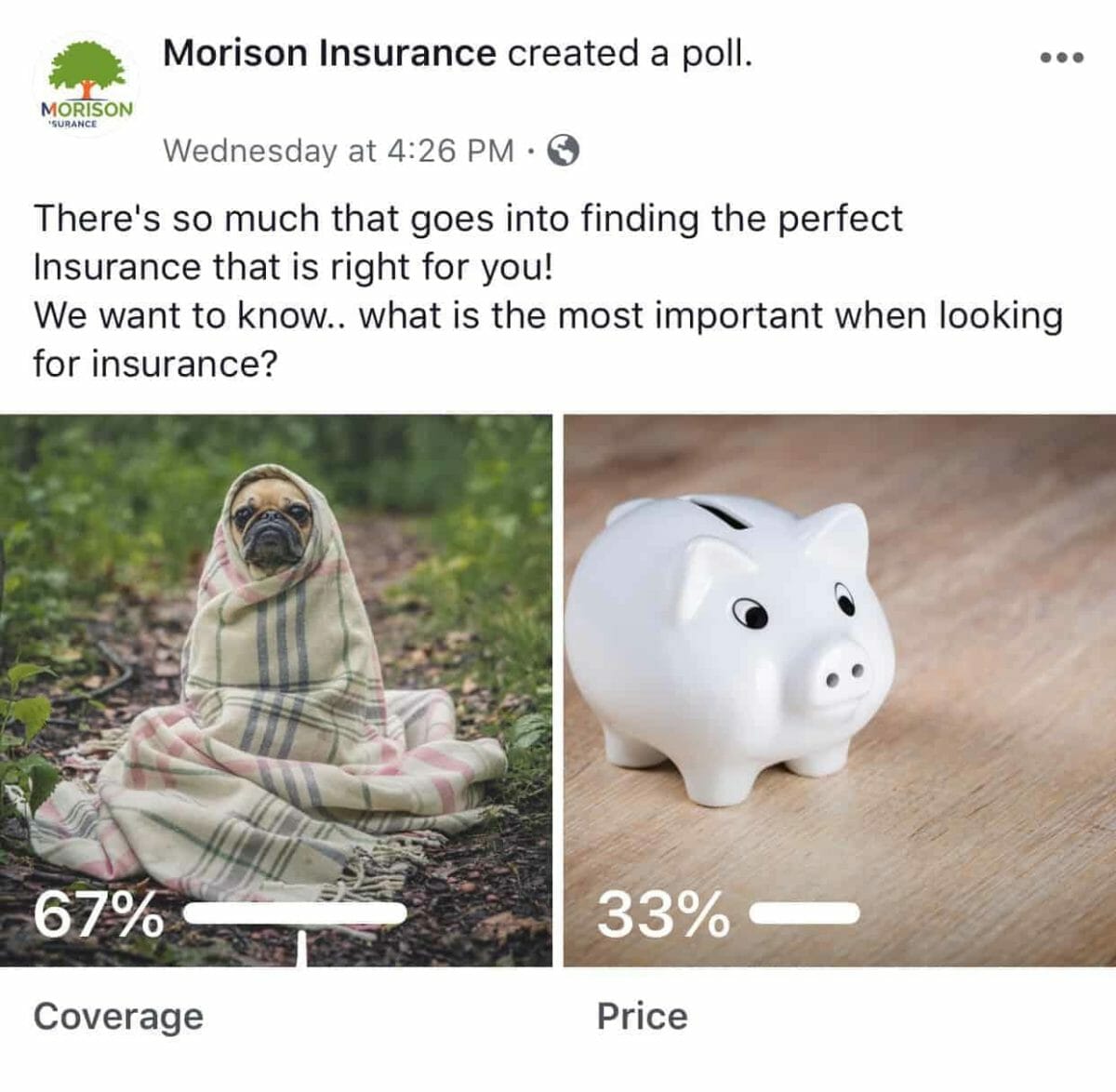

We asked our Facebook followers which was more important to them – having the best insurance coverage or a lower price? Our customers wanted the better insurance coverage!

Trusting an insurance broker and using their expertise to help you is the way to get the best insurance coverage value. Brokers will assess what your insurance needs are and make sure to compare those with the premiums at different insurance companies to offer you a fair price.

Life is very fast paced and busy for most of us these days. At times it is hard to slow down. Nothing will make us stop all together like suffering a loss such as an auto accident or having our home damaged by a severe event. Often if we are comfortable with our insurance premium and how it fits into our budget we tend to just carry on, bypass an insurance broker’s offer for a no-obligation quote. Even when we take a minute to get a quote, the only thing many people are focused on is the price. In insurance the “same” price definitely does not always equate with the “same” coverage.

Ask Your Broker How Good Your Coverage Actually Is

What if you had an auto accident and got sued? This is not the time to learn that your policy only had $1 million liability, you didn’t have rental car coverage, didn’t have forgiveness for your first at-fault accident and you have to pay a deductible.

What if your home is damaged by heavy rains but your policy did not have coverage for that? Ask an insurance broker to assess your insurance needs and shop the marketplace, and you will usually find that you could have much better coverage for the “same” price. Having to pay out-of-pocket for things you are not covered for is definitely not saving money. Investing a little time to work with an insurance broker is a great idea. We make things easy for you. Great brokers take time to explain different insurance coverages, assess your needs and get you several competitive insurance quotes.

Regardless of how simple or complex your insurance needs are, we encourage you to consider Morison Insurance where you have a dedicated broker who looks after your needs. Talking to a different person each time you contact a direct writer, call center or large insurance company may be OK when you have simple straightforward questions. However, when you have just suffered an unfortunate event, you want to speak to someone who cares, knows your policy and can help you with the claim. At times like these, comfort will be found by having your dedicated broker on the line, a person who knows you, where you live, work, knows your family. This is the personal service that adds value to your insurance protection. This is the way we do things at Morison Insurance. We are here for you when you need us most.

Three Takeaways:

- When buying insurance make sure you get a policy customized to suit you. Know your policy and speak to an insurance broker who is happy to explain any details or terms and coverage options with you

- Be aware that the lowest-priced policy may not provide the best coverage

- Discuss your needs and additional coverage options that, while they may cost a bit more at the outset, provide great value in the event of a loss or claim

The best insurance brokers will always work to help you get the best insurance coverage that fits your unique needs at great value.

What Do Great Insurance Brokers Offer Their Clients?

- They discuss your insurance needs with you to provide expert advice on insurance coverage options

- Within minutes they will shop at dozens of Canada’s top insurance companies to get you multiple quotes– each quote is tailored to you

- They discuss the insurance quotes with you, coverage details and price difference

- They get you insured with the insurance policy that’s best for you

- Their services won’t cost you anything

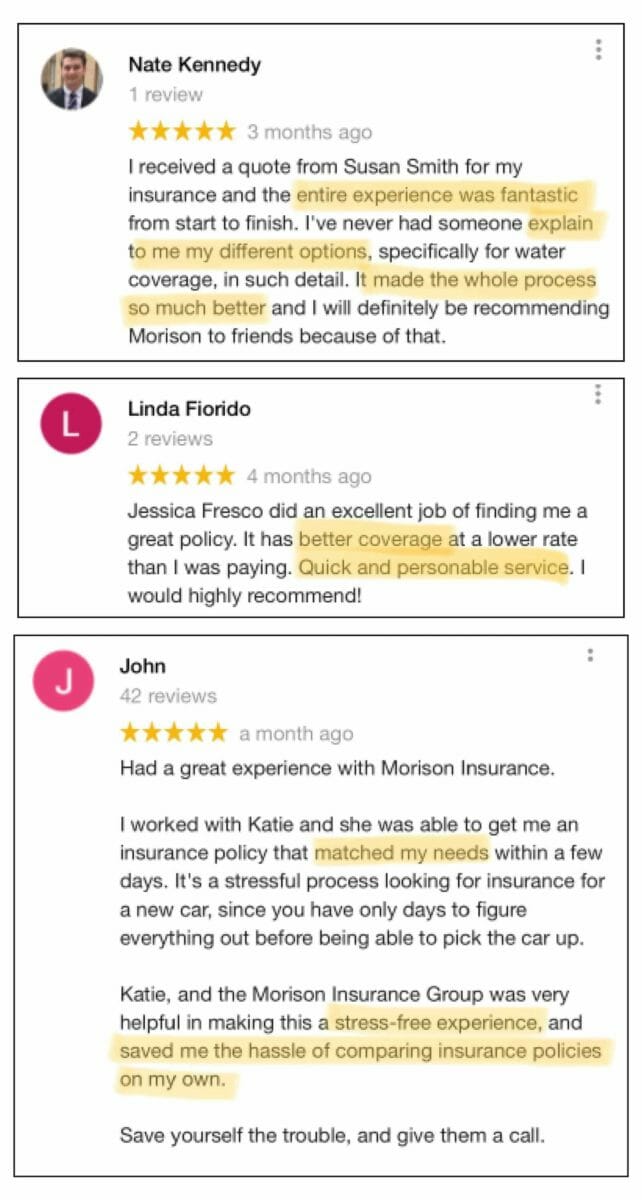

- They have a high number of 5-star online reviews (we’ve listed a few of ours below and encourage you to check out more on Google Facebook, and Yellow Pages).

Our customers are happy that their broker found them the best insurance coverage!

A great insurance broker should always want to save you as much money as they can, but at the same time they need to blend that with their commitment to ensure you are properly covered in the event of a claim.

Here Are A Few Examples That Explain Our Point

Real-life Situation #1:

Your home has extensive water damage after a sewer back-up or heavy rain. The basement is under water. Everything is ruined. You never discussed water damage protection when you bought the lowest-priced insurance policy from an insurance salesperson. Unfortunately, your insurance policy doesn’t cover water damage. You will have to pay for the repairs yourself. The price tag will be thousands of dollars.

Real-life Best Insurance Coverage Solution #1:

For a relatively small amount, you could have purchased water damage coverage with your insurance policy and the repairs would be covered. This is when the value of expert advice from an insurance broker and the best home insurance coverage demonstrates its value..

Real-life Situation #2:

You have an heirloom diamond ring. It’s expensive and irreplaceable. Your home is broken into and the ring is gone. Unfortunately, when you bought your home insurance policy, the salesperson never discussed your need for additional insurance to cover high-value jewellery. What will you receive to cover the loss of the ring? You will only get insurance to the policy limit. The amount you will receive will likely be far less than the value of the ring.

Real-life Best Insurance Coverage Solution #2:

Most insurance brokers have optional additional coverage options available to cover high value items such as jewellery, art, collections (i.e. stamps) and other things. For a modest amount you can insure these items to their value and, if you have a loss, you will have insurance protection that covers them to their value..

Real-life Situation #3:

You are in a car accident. Luckily no one is hurt, but your car is badly damaged. You can’t drive it. You need to get it repaired. Unfortunately, the repairs will take a few weeks to complete. How are you going to get to work? How are you going to get the kids to hockey and dance classes? You don’t have rental car insurance coverage. This was never discussed when you bought your insurance from the agent. You will have to pay for a rental car yourself.

Real-life Best Insurance Coverage Solution #3:

When you are buying auto insurance, insurance brokers can provide coverage for a rental car if your own car cannot be driven following an insured claim. For a relatively small amount, you can purchase rental car coverage.

Be sure to add rental car coverage to your policy to avoid paying out-of-pocket, or being without a vehicle, in the event of an accident.

Real-life Situation #4:

You are out at night, you get in your car to go home and the car won’t start. You will probably have to call a tow truck to boost the battery. Unfortunately, the insurance you purchased from the salesperson doesn’t include roadside protection with emergency towing service.

Real-life Best Insurance Coverage Solution #4:

If you had roadside protection through your insurance, you would have coverage for emergencies such as a dead battery, towing, a flat tire, keys locked in the car and more. Some insurance companies offer this protection as an additional coverage and it can be obtained at a reasonable cost.

As you can see, it’s important to know what you are buying when you purchase insurance. The details matter to ensure you have the best car insurance coverage.

Extra Coverage Options To Consider

Below are some optional/additional coverage options for your home and your car that provide good value in case of a loss. Please note that these lists provide a few examples only. For a more complete explanation of extra coverage options, please contact a reputable insurance broker.

What Are Some Extra Coverage Options For Car Insurance?

- Increased Third-Party Liability Coverage

- Optional Accident Benefits Coverage such as income replacement benefits, medical, rehabilitation and attendant care benefits, caregiver benefits, housekeeping and home maintenance benefits, death and funeral benefits, dependent care benefits, indexation benefits

- Specified perils Coverage

- Comprehensive Coverage

- Collision or Upset Coverage

- All Perils Coverage

- Rented or Leased Vehicle Coverage

- Loss of Use or Transportation Replacement Coverage

- Liability for Damage to Non-Owned Automobiles Coverage

- Removing Depreciation Coverage

- Family Protection Coverage

- Accident Waiver Coverage

- Disappearing Deductible Coverage

What Are Some Extra Coverage Options For Home Insurance?

These are often called endorsements.

- Water Damage Coverage

- Windstorm Coverage

- Sewer Backup Coverage

- Scheduled Personal Articles Coverage

- Equipment Breakdown Coverage

- High-Value Items Coverage

- Guaranteed Replacement Cost Coverage

- Umbrella Policy Coverage

- Bylaw Coverage

Have piece of mind knowing you have the best insurance coverage.

What Does It Mean To Have The Best Insurance Coverage?

Your best insurance coverage may not be the policy with the lowest price. The best insurance coverage is a policy that provides insurance protection suited to you.

When it comes to insurance, it is a not a case of one size fits all. On the contrary. Insurance is personal. Whether it is your home insurance, car insurance, business insurance, recreational insurance or another insurance product, getting the best insurance coverage at the best value is important, and with the help of a reputable insurance brokerage, is completely possible.

What Are Three Things To Consider When Looking for The Best Insurance Coverage?

Here are three tips to get the best insurance coverage, according to one of our brokers:

- Proper coverage. Individualized rating helps our brokers find the best insurance coverage/ products for you

- Work with a broker who is a trained and licensed resource for any questions you may have and who also provides personal service

- Work with a broker who will shop at multiple insurance companies to provide you with a choice of coverage options and prices

Bottom line? Get value for your insurance spend, says another of our Morison Insurance brokers. When you insure with Morison Insurance you are not only getting insurance, you are also getting many extras/value-added services that many brokerages and insurance company agents do not offer. Our dedicated, independent and expert brokers are here to help you find the best insurance coverage.

Another important point is that insurance can be complicated. It is very important to understand your policy, coverage option, exclusions, limits and other details. Insurance brokers are trained on the details of insurance and are happy to help.

What Coverages Should Be Added For Proper Protection?

Below are two examples of coverage options that you may want to have included in an insurance policy, depending on your individual situation and how much insurance protection you want.

1. Bylaw Coverage:

If you own an older home or cottage you may want to have bylaw coverage. This provides insurance protection in case you have to rebuild and are subject to current building code regulations by the municipality where your dwelling is located. Rebuilding to current building code standards could significantly increase rebuilding costs. Bylaw insurance coverage protects the owner against losses incurred from enforcement of bylaws which would increase the cost of repair or rebuilding after a loss. Bylaw coverage may be included in your insurance policy, however, increased limits are available to purchase if needed.

Many homeowners don’t think they need bylaw coverage. However, what if you have a significant loss in your 30, 60 or 100-year-old home. Your insurance will likely cover tear-down, cleaning and rebuilding costs, but it may not cover costs to adhere to current bylaw regulations.

It is generally understood that if your home is more than 10 years old, it probably does not meet today’s building requirements. Purchasing bylaw insurance with your home policy would provide you with your best insurance coverage.

2. Waiver Of Depreciation Coverage:

As many people know a new car depreciates the moment you drive it off the lot.

If this concerns you, most insurance companies offer coverage called OPCF43 Waiver of Depreciation, to waive depreciation in the event your vehicle is a write off or a total loss within the first couple of years after you buy it. The cost for the coverage is generally $5 -$10 a month, and it could save you thousands. Think about a vehicle you bought new and drove for a short time. If you were in an accident and the vehicle could not be repaired, your claim settlement will reflect the value of the vehicle at the time of the accident if you don’t have the waiver coverage. If you buy OPCF43 Waiver of Depreciation, your claim settlement will be for the purchase price, less your deductible.

This coverage removes the right of the insurance company to deduct depreciation from the value of your automobile when settling a claim for loss or damage. The company will pay the actual purchase price of the automobile and its equipment or the manufacturer’s suggested list price of the vehicle and its equipment on the date of purchase, or the cost of replacing the automobile with a new one of the same make and model which is similarly equipped.

OPCF43 Waiver of Depreciation coverage will waive depreciation in the event your vehicle is a write off or a total loss within the first couple of years of purchase.

How Do I Choose The Best Insurance Coverage?

Your best insurance coverage will come from speaking with an excellent insurance broker. Insurance brokers, unlike other insurance sales people, do not work for an insurance company, they work for you. Generally, they will shop at dozens of Canada’s insurance companies to get you the best insurance coverage and value, and their services shouldn’t cost you anything!

When you contact one our brokers, we will take the time to get to know you. Do you have an older home, are you mortgage-free, do you have monitored smoke and/or burglar alarms, do you have outbuildings on your home property? Answers to these questions and others will enable us to help you get the best insurance coverage. We will then shop at many insurance companies to get you a competitive insurance price. Getting this information and providing you with several competitive quotes is done quickly by our brokers.

Examples Of When The Best Insurance Coverage Outweighs Price:

Remember, the best insurance coverage has you prepared for the “what if’s” before a loss.

Here are two real-life stories from two of our brokers to show you the value of having the best insurance coverage.

Broker Mandy’s Story:

There are a few old sayings which come to mind when comparing coverage versus premium “You often get what you pay for” and “If it seems too good to be true, it probably is”. A client recently left our brokerage to go to a direct writer. When I called him to compare my Morison Insurance quotes to what the other company was offering him, I found he was being short-changed when it came to coverage.

Yes, their price was lower, but he was only getting $1 million in Liability Coverage, a higher deductible for Collision and Comprehensive Coverage, no increased Accident Benefits Coverage and low Loss of Use Coverage.

I pointed these differences out to him, however, he was only interested in the savings. If this client has a claim now with this policy, he will be very surprised at what he was sold. Our society is very litigious and if he is sued for $2 million and his current limit is only $1 million he will have to pay for lawyers on his own to defend him against the difference in coverage and what he is being sued for. For example, if he is sued for $2 million he will have to defend the remaining $1 million and if a judgement is awarded against him he could be on the hook for paying the remaining $1 million. He will also find if he is injured in an accident his medical coverage is now the standard benefit, not the increase amounts he had with his policy at Morison Insurance, and he will responsible for the difference if he requires Medical Rehabilitation or Attendant Care. He may find out that the premium he was quoted with us was, in fact, the best option.

Broker Samantha’s Story:

When coverage matters, price should not always be the main priority, especially when it involves your most valuable possession, your home.

Recently a client contacted our office to advise that he was going to be leaving our brokerage and placing his home with his financial institution. The client would be saving $300. As our discussion progressed, it was established that certain coverage options would not be the same on the new policy. Liability limits were reduced from $2 million to $1 million, claims protection was not included, sewer back-up coverage was dramatically reduced which would barely cover clean-up costs let alone contents, flooring materials, a furnace and other items that could be potentially damaged in a water claim. Also, overland water coverage was not available with the financial institution.

The new policy would leave the client in a vulnerable position should a claim occur. Is saving $300 worth potentially thousands of dollars that would be spent by him in the event of a claim? This is an important question one needs to ask themselves when sacrificing coverage for price.

Insurance premiums are calculated based on many different factors and the uniqueness of each individual’s risk. An insurance premium is the amount of money an insurance company charges you for an insurance policy. The amount of the premium is calculated based on personal details such as for your home insurance where you live, how long you have lived there, if your home is new, updated, has a monitored security system and more. For auto insurance, details such as the make, model and year of your vehicle, your driving history, how far you drive and other information are taken into account.

Premiums can be different at different insurance companies which is why it is important to work with an insurance broker who can shop and compare prices at different companies for the best insurance premium and value.

To help push down your premium costs, insurance brokers will look for discounts that can be applied. These can include a non-smoker discount, a mortgage-free discount, a retiree discount, a driver training course discount and more.

Ways To Save On Insurance

We all like to save money and insurance brokers are always looking for ways to help you save on your insurance. Just don’t forget that saving money is only part of the insurance buying process. You need to ensure you’re properly protected and covered in the event of a claim!

- Discounts are great ways to save on your insurance. We have access to dozens of discounts and we will get you all the discounts you qualify for. Note that discounts differ among companies

- A great way to save is to bundle two or more of your insurance policies with one company. Many insurance companies offer sizable savings if you insure you home, car and other items such as cottage, travel trailers. We can help you with this

- Switching mid-term and being charged a penalty before your policy expires can save you money. Here is why: Penalties for changing your policy from one insurance company to another mid-term does not necessarily cost you more. Many people think that due to an early cancellation penalty they cannot or should not cancel a policy mid-term. Often people believe a mid-term cancellation penalty means they will end up spending more for their insurance when all is said and done. This is not necessarily true. As one of our Morison Insurance brokers said recently: “We need to bust the myth that changing your insurance early is a bad thing.” If an early cancellation penalty is $100 but by changing your insurance mid-term you are able to save $600 annually on a different policy, the total savings is $500 over a year. In these kinds of cases, it is definitely worth changing mid-term, notes our broker

- You can save on auto insurance by participating in a driving program offered by some insurance companies that rewards good drivers. These programs involve using an app that will track your good driving and reward you with savings. In some cases, drivers can save as much as 30% on their auto insurance. With the average auto insurance rate being between $1,500 and $1,900, a 30% savings is substantial. In the case of a $1,500 premium, the savings could be as high as $450! In the case of a $1,900 auto insurance premium, the savings could be as high as $570! Contact our home and auto insurance brokers at Morison Insurance and we’ll tell you more about these potential savings

- Maintain a good driving record

- Pay annually, not monthly

- Complete an accredited driving course

How Do I Get The Best Insurance Coverage That Is Also affordable?

- Ask your broker to shop for the best insurance coverage for you and the best insurance value

- Select with an insurance broker who is focused getting you the best insurance coverage, savings and service. Check out our reviews on Google, Facebook and Yellow Pages to read what or customers are saying about Morison Insurance. Our focus is entirely on the customer, great insurance products and coverage options, service and fair prices.

- Be aware of the ways you can save

- If your insurance needs a change, let your broker know

Call Your Insurance Broker When:

Your Home:

- You renovate your home or finish your basement

- You update your heating, plumbing, electrical or roof

- You install a monitored alarm system

- You install a sump pump or backwater valve

- You pay off your mortgage or your mortgage is a line of credit

- Your home becomes vacant or your occupancy changes

- You start a home-based business

- You have high-valued items such as jewellery, as all policies have limits

Your Car:

- Your commute distance or annual mileage changes

- You have a newly licenced driver or additional drivers

- You modify your vehicle

- The use of your vehicle has changed to business: deliveries, job sites, Uber etc.

Changes such as these can impact your insurance coverage and your insurance protection is important.

What Is The Cost of Not Having The Proper Insurance Coverage?

If you don’t have the proper insurance protection, you could find that in the event of certain kinds of losses/claims, you do not have adequate insurance protection.

The details of your policy and knowing what insurance coverages you have are very important. Paying for an additional or enhanced coverage could save you plenty of money in the event of a claim. Rely on an insurance broker to provide the best insurance products, guidance and service.

What Happens When You Choose Price Over Insurance Coverage?

When you choose price over coverage, you may not be covered in the event of certain losses or claims or your insurance coverage may be limited. This means that in the event of a loss that is not covered by the policy, you will have to pay for it yourself. In the event of a loss that is covered but which exceeds the limit on your policy, you will only be covered to the limit on the policy.

The Benefits Of Having An Insurance Broker:

There are many benefits of having a broker when you are looking for the best insurance coverage. Below are the benefits of working with our Morison Insurance brokers:

- We work for our customers, not an insurance company

- We provide you with insurance choices. We reach out to dozens of insurance companies to get you insurance quotes, compare prices and get you the best insurance coverage at a competitive price. Note that when you work with a direct insurer’s agent (an insurance company’s salesperson) you are not getting choice, you are getting one price from one company

- There is no extra cost to use our services

- We are here for you. Our customers are the focus of everything we do. We are not a large company where customers are known by their account numbers. We care about every customer and we provide personal award-winning service

- We are trained and licensed to sell insurance through the Registered Insurance Brokers of Ontario (RIBO), a provincial regulatory body. We know insurance and we will explain the details of insurance, provide advice and guidance

- We provide a dedicated broker to our customers who will answer any insurance questions you may have

- We provide guidance and support in the event of a claim to help with resolution

- We can help with all of your insurance requirements – home, auto, business, life and more – as you and your family’s life and insurance needs change, our Morison Insurance brokers are here to help!

- We are dependable. We have nine offices to serve you. We are available by phone, email and text. We also have a 24-hour claims service

- We serve you your way. Do you want to speak to your broker personally? You got it at Morison Insurance. Do you prefer to use digital services? We have this too!

- We are efficient. We know you are busy. We will look after your insurance needs quickly and efficiently. Be it a quote, a service need or to report a claim, we will have your looked after professionally and promptly

- We are on top of technology to serve you better. As a national award winner for digital innovation, we are able to serve you in the most efficient way possible. E-signature service, quick quotes, more are provided to every Morison Insurance customer

How A Morison Insurance Broker Can Get You The Best Insurance Coverage

When you contact us for an insurance quote, our Morison Insurance brokers will:

- Discuss your insurance needs with you and provide professional advice.

- Get multiple quotes for you promptly and discuss the coverages and prices with you.

- As we do with every customer, we will provide you with first-in-class customer service from your own dedicated broker and our entire award-winning broker team.

For more on how we do insurance at Morison Insurance and what our customers are saying about us, check out our reviews on Google, Facebook and Yellow Pages.

This content is written by our Morison Insurance team. All information posted is merely for educational and informational purposes. It is not intended as a substitute for professional advice. Should you decide to act upon any information in this article, you do so at your own risk. While the information on this website has been verified to the best of our abilities, we cannot guarantee that there are no mistakes or errors.